DIGITAL LEARNING & SOFTWARE SOLUTIONS

We can meet all your digital learning needs with our cutting-edge learner management systems, administration platforms and online learning resources.

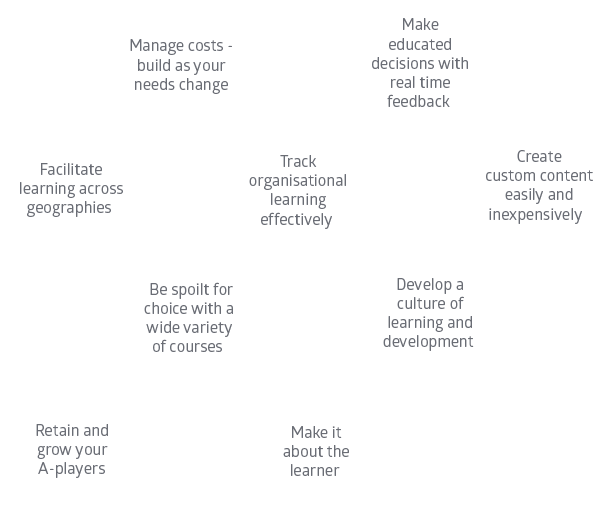

DIGITAL LEARNING BENEFITS

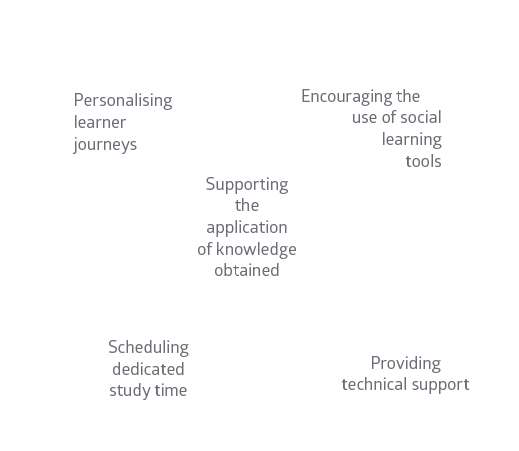

THE SECRET TO SUCCESS

Digital learning is a learner-centric user experience designed to easily and effectively upskill your people to adapt to modern-day business needs.

Success requires:

Key factors: