Extension of the Section 12H Learnership Tax Incentive by 3 years

In his most recent budget speech South African Minister of Finance, Enoch Godongwana, announced yet another extension has been made to the sunset date of Section 12H Learnership Tax Incentive.

This recent extension implies that businesses may continue to enjoy relaxed tax benefits for learnership agreements that started on or prior to 31 March 2027, providing businesses with an extended window of opportunity to invest in skills development and maximise their tax benefits.

Fostering Economic Growth Through Skills Development

Historically, South Africa has grappled with crippling levels of unemployment. Moreover, young adults and graduates who are born-free have always struggled to secure a job. Additionally, there has been persistent skills gaps in various industries, hindering productivity and economic growth. Recognising these challenges, the government sought to address them through targeted interventions. Interventions such as the Section 12H program, which was initially introduced in October 2001. By incentivising businesses to participate in learnership programs, the initiative aims to tackle unemployment - by providing valuable opportunities for skills development and on-the-job training. Additionally, the program aims to bridge the skills gap where employees will be equipped witht he necessary knowledge and skills required in the new economy.

Through this program, the government not only aims to address pressing pain points but also fosters a more inclusive and resilient economy for the benefit of all South Africans.

What is Section 12H?

Section 12H of the Income Tax Act provides a valuable tax incentive for businesses investing in learnership programs. It allows eligible businesses to claim a tax deduction for qualifying expenses incurred in investing in approved learnership programs, provided there is a binding learnership contract in place.

Businesses can claim a tax deduction to equal the actual costs incurred in hosting learnership programs, including stipends paid to learners and training expenses*. These deductions can be used to recoup the cost of the Learnership programme. To qualify for the incentive, the learnership program must be registered with the relevant authorities and meet specific criteria outlined in the Income Tax Act.

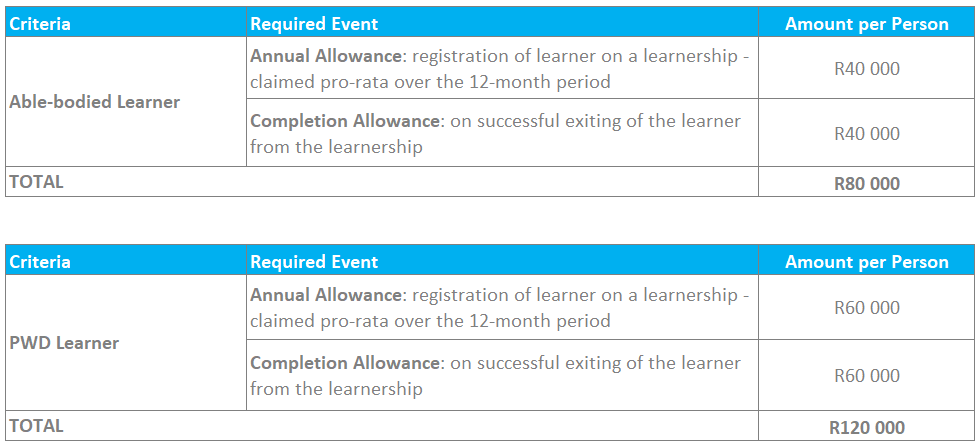

The below tables stipulate the applicable allowances

Take the next step!

Ready to unlock the benefits of the Section12H Learnership Tax Incentive? Contact iLearn today to learn more about how we can help you navigate this process. Thus reaping the rewards of tax savings, sustainable growth, and invest in a brighter future for South Africa.